Irs Personal Mileage Rate 2025 - Irs Personal Mileage Rate 2025. 22 cents/mile moving (military only): 14 announced that the business standard mileage rate per mile is rising to 67. This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

Irs Personal Mileage Rate 2025. 22 cents/mile moving (military only): 14 announced that the business standard mileage rate per mile is rising to 67.

2023 standard mileage rates released by IRS, This is 1.5 cents higher than it was in 2023, at 65.5 cents per mile. Irs mileage rate change in 2025:

IRS Announces the 2023 Standard Mileage Rate, In 2023, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving. That drops to 14 cents per mile when.

Me Chat Codes 2025. To make it easier for our members to find codes, please […]

67 cents per mile, up 1.5 cents from 65.5 cents in 2023.

22 cents/mile find out when you can deduct vehicle mileage.

Cole Swindell New Song 2025. December 4, 2023 | last updated: He is the latest […]

New 2025 IRS Standard Mileage Rate Virginia CPA firm, For tax year 2023 (the taxes you file in 2025), the irs standard mileage rate is 65.5 cents per mile when used for business. This was a three cent increase from the second half.

The 2025 irs mileage rates have been set at 67 cents per mile to accommodate the economic changes over the past year. The standard deduction gets adjusted regularly for inflation.

California Employers and the IRS Business Mileage Rate for 2023 Ethos, That drops to 14 cents per mile when. In 2023, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving.

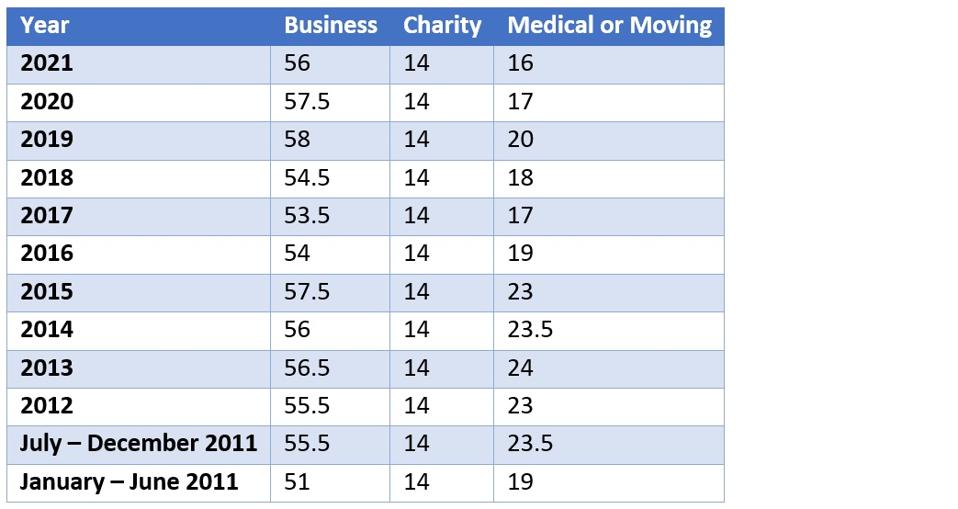

Table showing historical IRS mileage rates, The irs mileage rate in 2025 is 67 cents per mile for business use. The standard deduction gets adjusted regularly for inflation.